Setting the Problem

Construction sites require power to operate their large equipment (e.g., cranes, hoists, welders).

Construction equipment require large amount of power (kW) to work but it only requires this power for a small percentage of time (around 4% of the day). Obtaining large amounts of power from the grid periods can be challenging and a lengthy request process.

As a result, construction sites often rely on diesel generators to supply the necessary power.

Diesel generators have several drawbacks:

They emit harmful air pollutants to the environment.

They can be noisy.

They are prone to downtime due to breakdowns or refueling, which leads to disruptions in operation.

They have a high carbon footprint.

Solution

Ampd Energy introduced the Entertainer, an energy storage system specifically designed for construction projects to replace diesel generators on-site.

The Entertainer (pictured above) utilizes 30,000 lithium-ion batteries to store and deliver energy.

The system can connect directly to the grid (or other energy sources, e.g., renewables), without any special requirements, for charging.

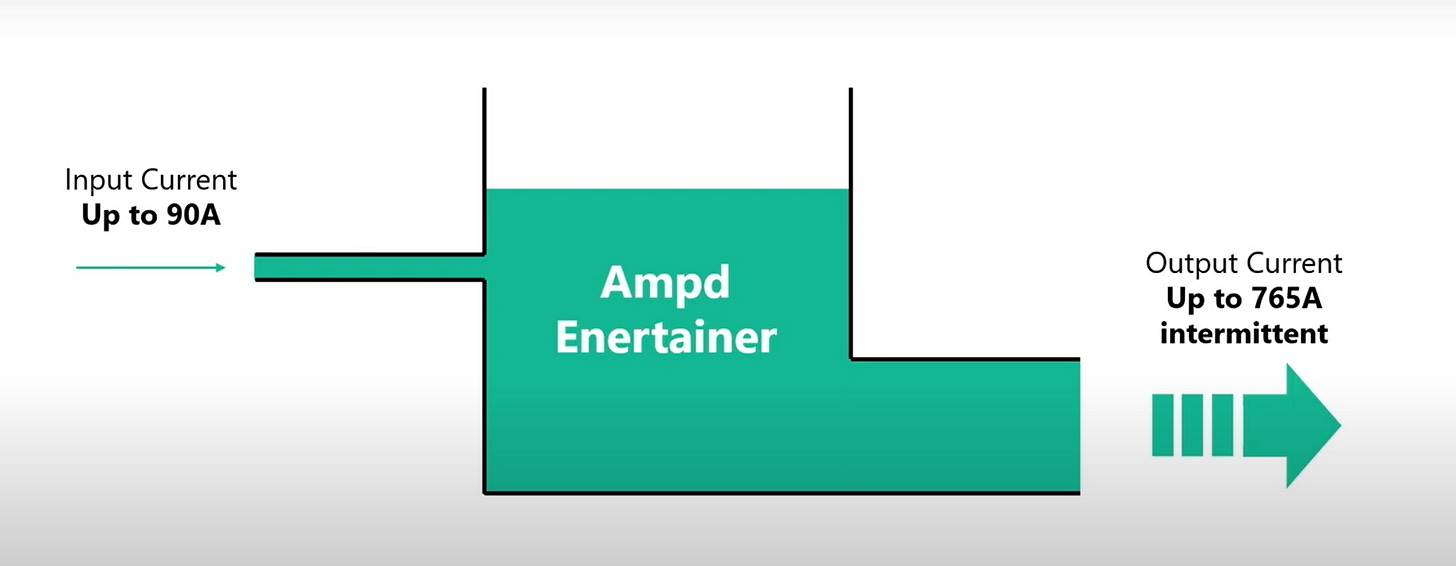

It is able to power equipment with high intermittent demand (as seen below).

Currently, it powers cranes, hoists, concrete batching plants, welders, and site offices.

Benefits

Up to 70% reduction in operating costs through lower fuel costs.

Creates a cleaner, less noisy environment by eliminating diesel fuel.

32 times less noisy compared to diesel generators, allowing work to continue during noise-sensitive periods.

Requires low maintenance and no refueling, decreasing downtime.

Significant reduction in GHG emissions—150-200 tonnes reduction per unit per year.

The platform provides data points every 5 seconds showing the operation of the Entertainer and equipment connected to it. The platform provides carbon reduction stats and monthly reports that can be used for ESG reporting and green financing.

Estimated Payback Period

The payback period varies based on the price of wholesale diesel and electricity in each country. Estimates were based on case studies and quotations found online. The payback period does not account for any government subsidies or grants or take into account the man-hours saved.

Singapore - 6 years

UK - 6 years

Hong Kong - 7 years

UAE - 8 years

US - 11 years

Australia - 24 years

Potential Market

The market size for diesel generators was valued at USD 19.46 billion in 2023 and projected to grow to USD 37.03 billion by 2032 with a CAGR of 7.45%.

The Basics

Headquarters: Hong Kong

Year Founded: 2014

Company Size: 80 - 100 Employees

Investors: 2150, Taronga Ventures, MTR Labs, ParticleX, and HSBC

Amount Raised: 19.7 million USD

Business Model: The product can be bought or licensed. Additional costs apply for premium support plans and premium web monitoring/data analytics package.

Warranty: 5 years, with an additional cost for an 8-year warranty.

Presence: Hong Kong, Singapore, UK, Australia, US, and UAE.

What do we like

The Entertainer was developed in collaboration with Gammon Construction with the specific goal of replacing diesel generators. Through this, Ampd Energy built their expertise and created an excellent product.

The discussion surrounding the banning of diesel generators is becoming increasingly relevant due to their significant environmental and health impacts.

Green buildings, green financing, and decarbonization are becoming key focuses for new construction.

They are partnered with MTR Labs (owned by MTR, a public transport operator and property developer in Hong Kong) and currently work with some of the biggest construction companies.

What we do not like

Only around 200 units (reported in 2023) have been sold since the product was first introduced in 2019. This could be attributed to several factors—Covid-19, higher interest rates, and the slowdown in construction during this period.

The Entertainer is estimated to be around 3 - 4 times the price of traditional diesel generators.

Other Opportunities

Ampd Silo (a mini version of the Entertainer) was initially introduced for facilities impacted by short blackouts. There is great potential in pivoting this for other uses, such as demand management in countries with high demand costs (e.g., the US). It could be used in conjunction with ADR programs.

The entertainment industry, like construction sites, relies on diesel generators to power production and live events.

Competitors

Moxion (US): Sold 300 of its first-generation product (similar to the Entertainer) in 2023. Secured $100 million in a Series B round. Announced bankruptcy in July 2024 due to growth mismanagement. Insiders say they tried to scale up production before resolving technical problems and relied heavily on early customers rather than achieving the right product-market fit.

Northvolt (Sweden): Started by two former Tesla executives, Northvolt specializes in manufacturing lithium-ion batteries primarily for electric vehicles. They raised 15 billion euros in equity and debt. Main shareholders include Volkswagen, Goldman Sachs, and BMW. They have reportedly secured over 50 billion in contracts for battery supplies. They have started exploring providing energy storage systems to construction sites. Currently, they are facing a large net loss as they fail to produce at scale.

Unknown Factor

The ease of scaling production on the Entertainer.

Unit Economics of the Entertainer

Is the 19.7 million dollars raised enough to successfully expand

Founders

Brandon Ng (CEO): Brandon holds a degree in Chemical Engineering from Imperial College London and is a Forbes 30 Under 30 Asia: Industry, Manufacturing & Energy Honoree.

Luca Valente (CTO): Luca holds a Master of Science in Mechanical Engineering from Pontifícia Universidade Católica do Rio de Janeiro and an MBA from CKGSB in Beijing. Before founding Ampd Energy, Luca worked in engineering roles at Volkswagen and Embraer and led engineering teams in China.

Interesting article!